FACChairs,

BC Ferries Traffic Stats Download: July_2018_Traffic_Stats

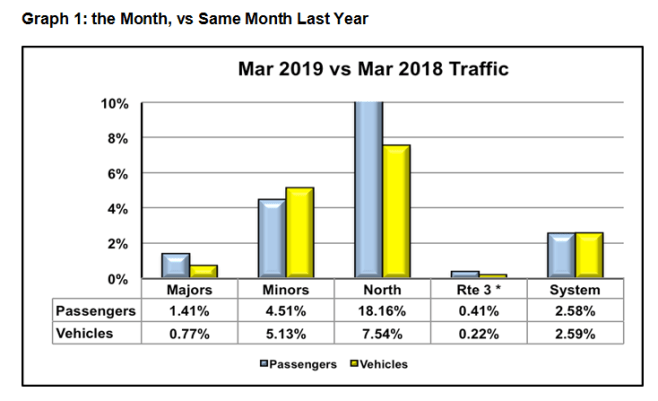

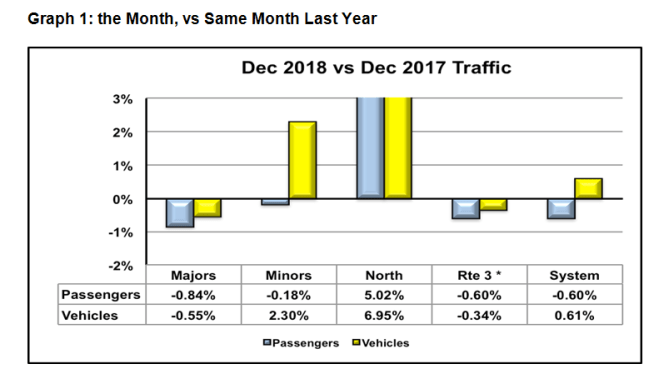

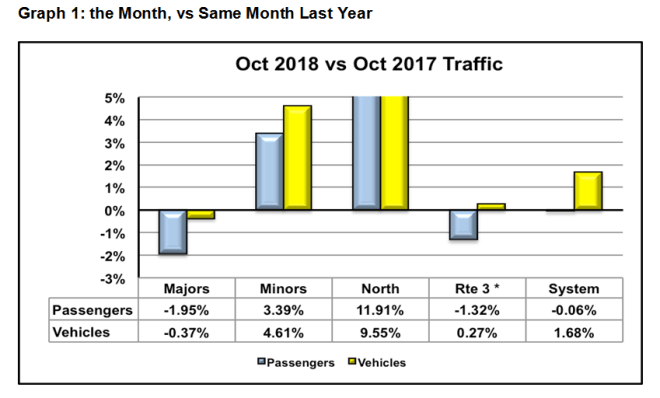

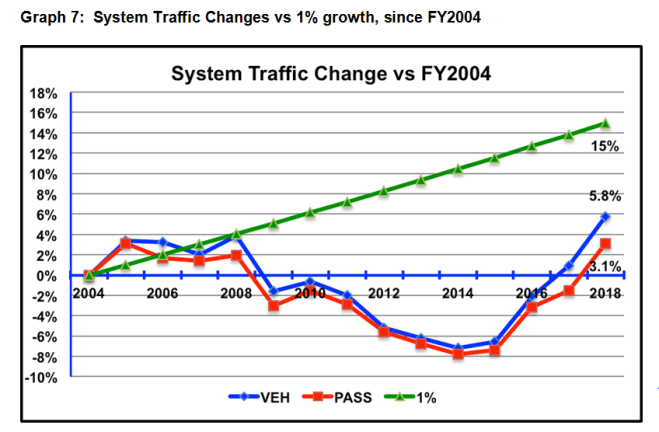

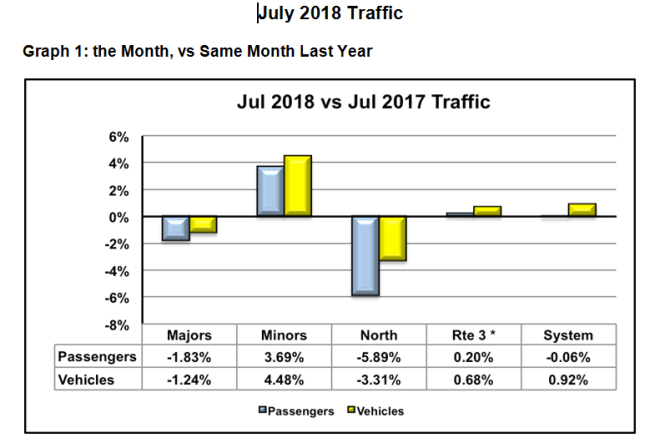

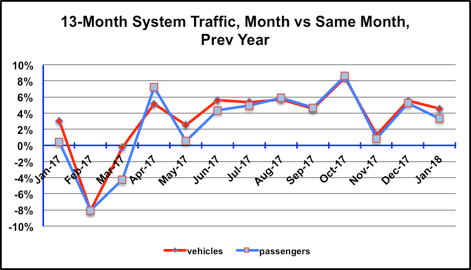

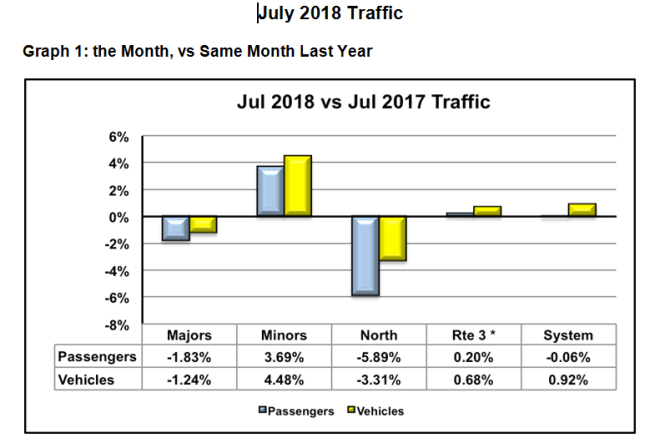

A smoky month with surprising, and not so surprising, traffic results. System vehicle traffic was up 0.9% while passenger traffic was down 0.06%. Graph 1.

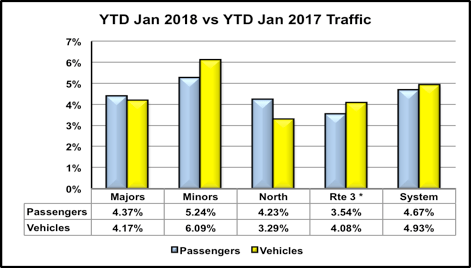

The Majors were down from last July on all but Rte 3, which is essentially flat. As per Graph 1, vehicles down 1.2%; passengers, 1.8%. Disappointing, but not the end of the world.

Meanwhile, the Minors were up significantly on almost every route, vehicles 4.5%; passengers, 3.7%.

How could this be?

The Majors’ drop is likely due to two things, the first being the pervasive pall of smoke. It’s keeping out-of-province visitors away, and keeping British Columbians home. That and last year was a bonus traffic summer for ferries as many vacation travel plans were redirected to the coast due to the devastating wildfires in the interior. That bonus factor was gone this year as coastal destinations were equally blanketed with the Grey Misery. So, the smoke dampened travel and the traffic comparison was to an inflated high volume last year. Traffic off, no surprise.

But the Minors had the same smoke and the bonus traffic last year.

Indeed. But the Minors also had a 15% fare reduction, not enjoyed by the Big Three Majors. Price elasticity still seems to work.

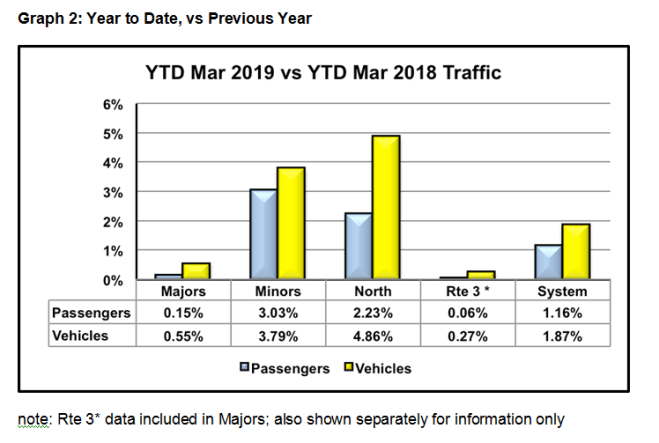

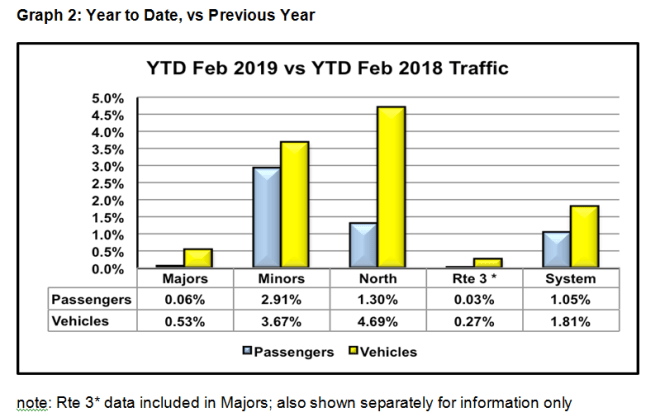

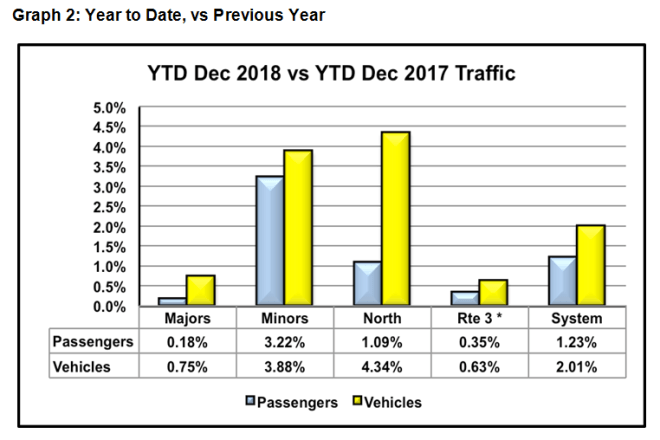

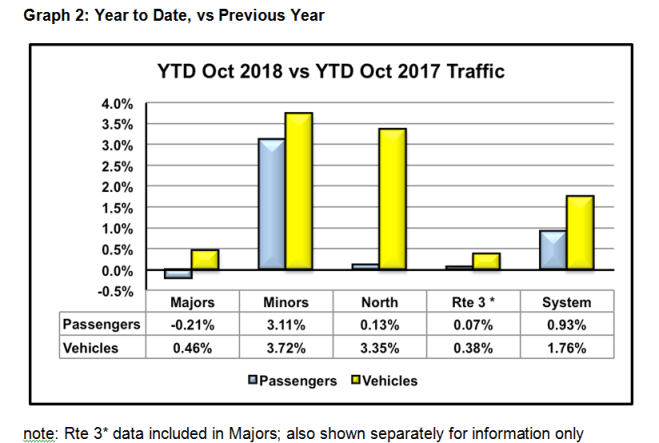

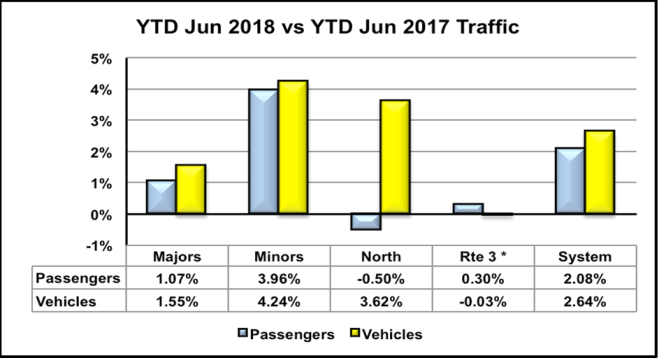

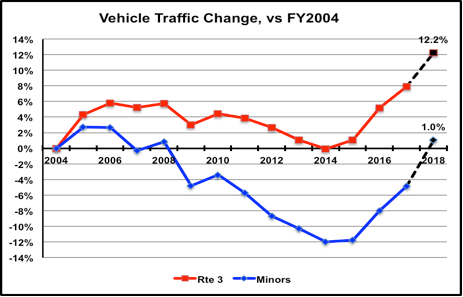

From Graph 2, it’s evident the Majors’ traffic has substantially lagged that of the Minors since April. The modest System traffic growth is almost entirely due to the Minors’ contribution.

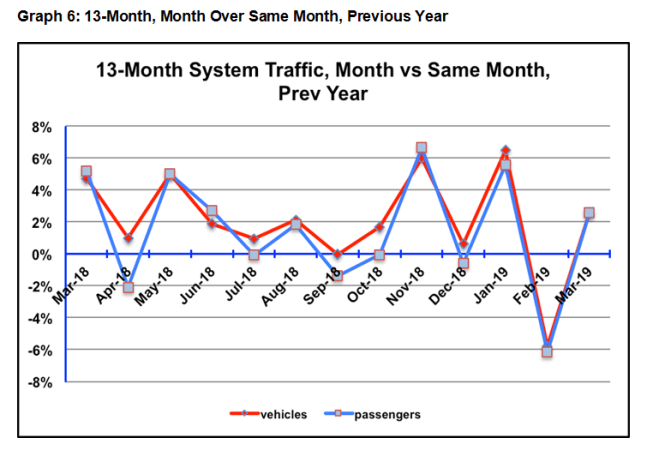

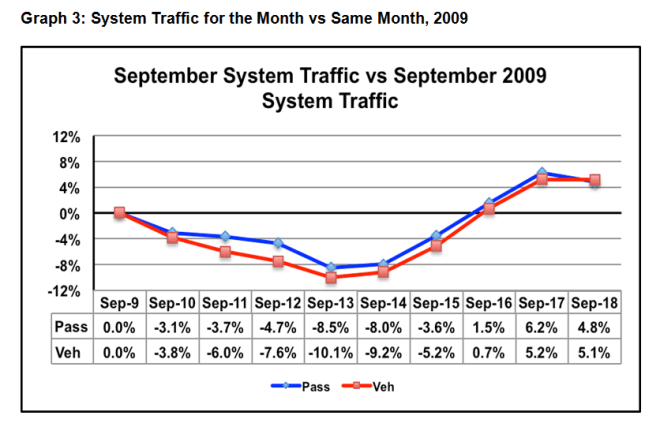

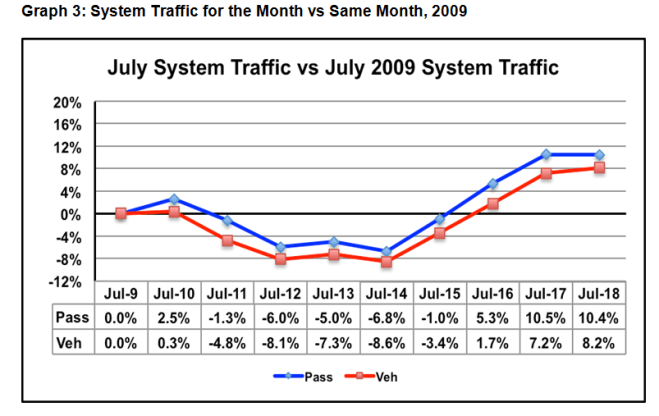

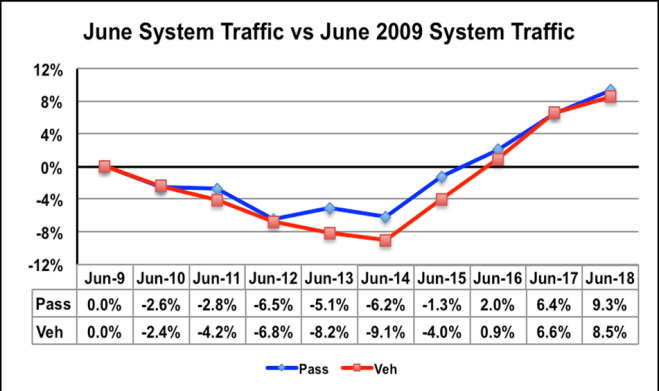

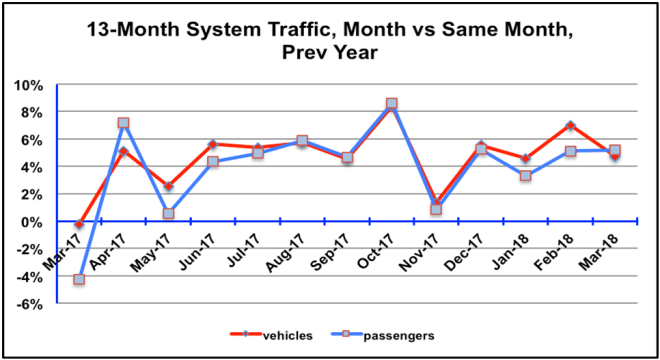

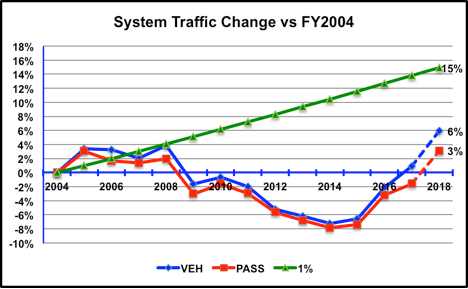

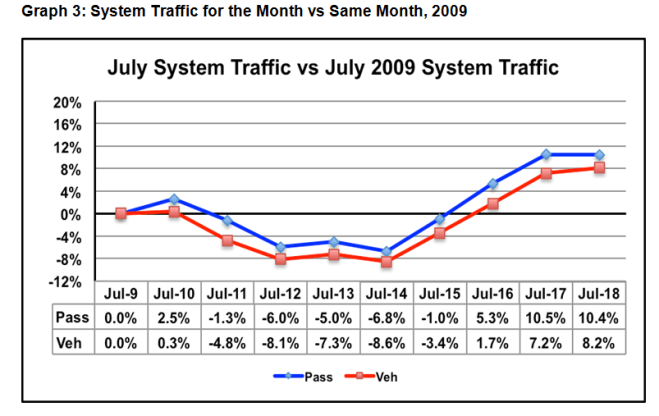

System traffic this July essentially stalled at last year’s level, after three years of steady growth (Graph 3). Traffic was dampened on one hand by the smoke and buoyed on the other by the 15% fare cut (Minors, Rte 3 and the North) and return of the seniors’ freebies.

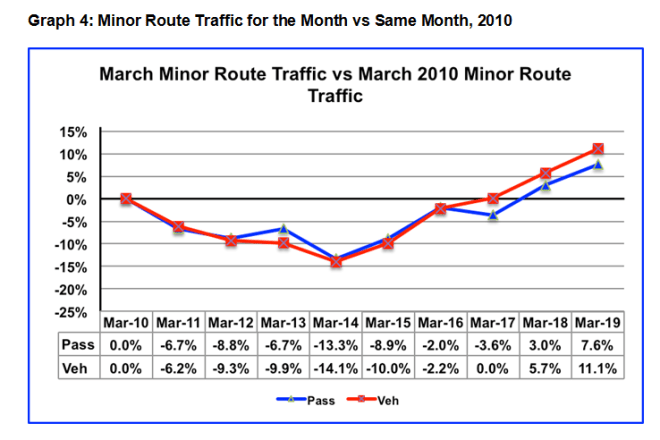

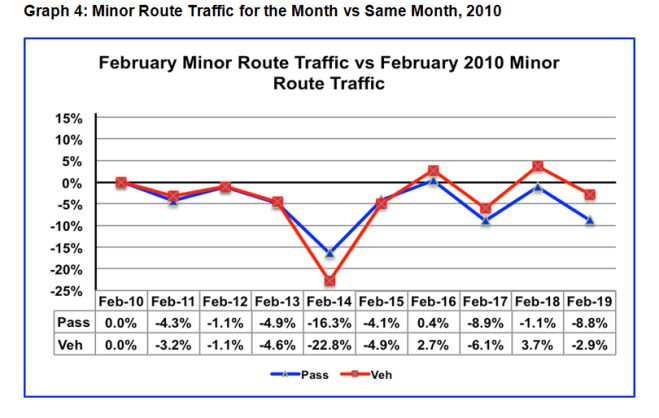

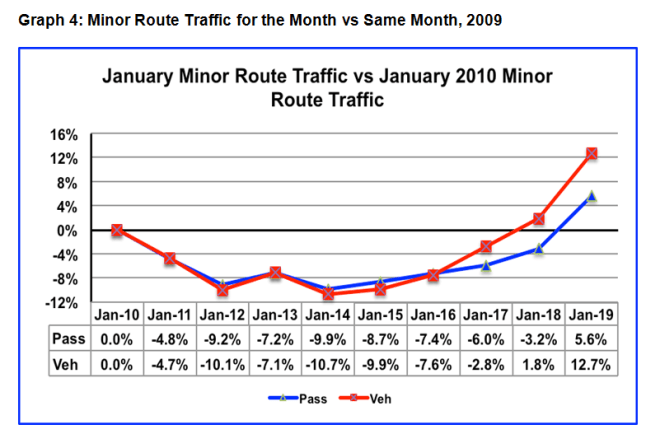

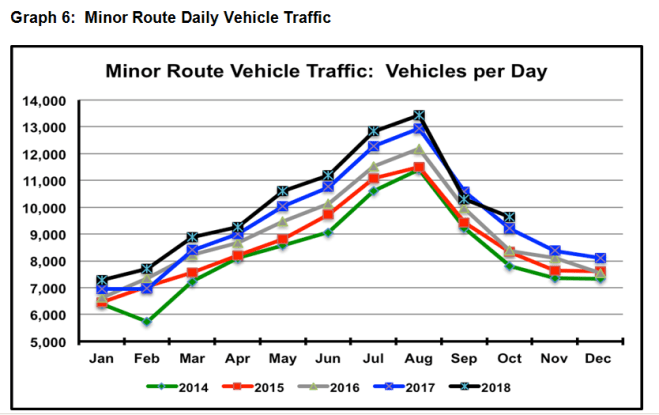

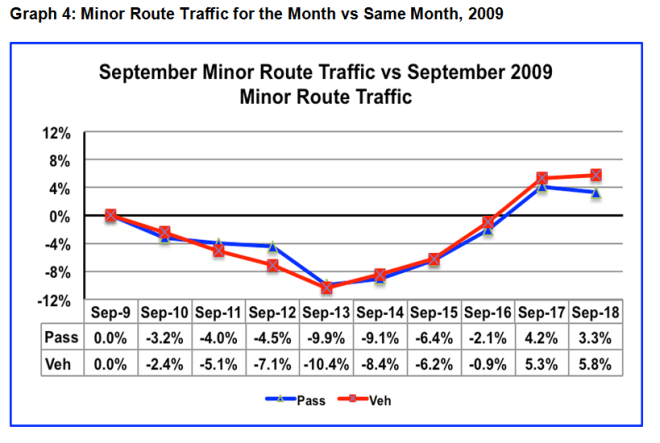

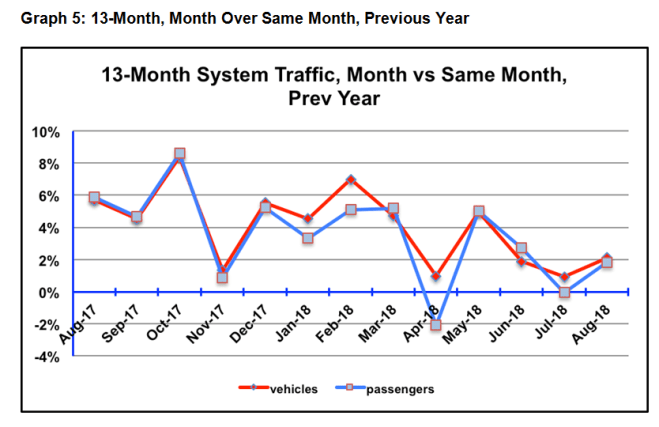

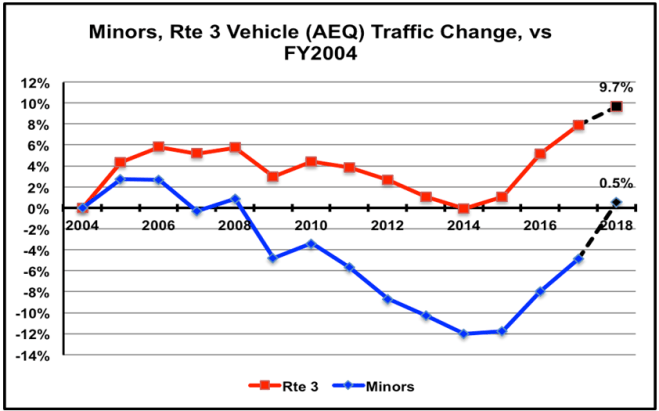

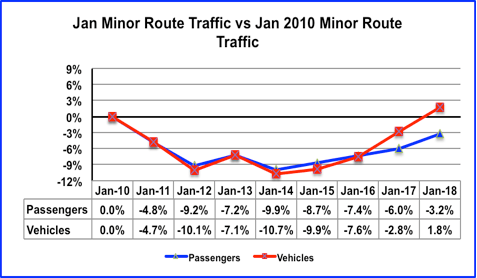

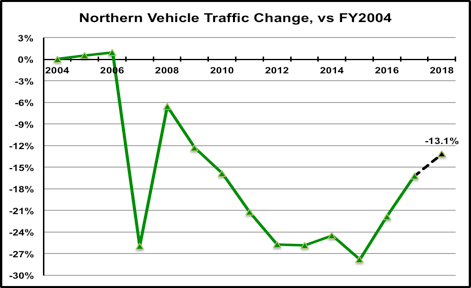

Meanwhile, Minor route traffic this July notched a fourth straight year of substantial growth (Graph 4), thanks in large part to the 15% fare cut. As discussed previously, the traffic boost is good for local businesses and the general well-being of the communities. But the inability of BCF, with its limited capacity to accommodate the increased demand, is leading to unprecedented sailing waits on more routes, and more sailings on those routes. While nobody would suggest raising fares to constrain traffic, the longer and more frequent waits are becoming increasingly painful. The new, greater capacity ferries are eagerly awaited.

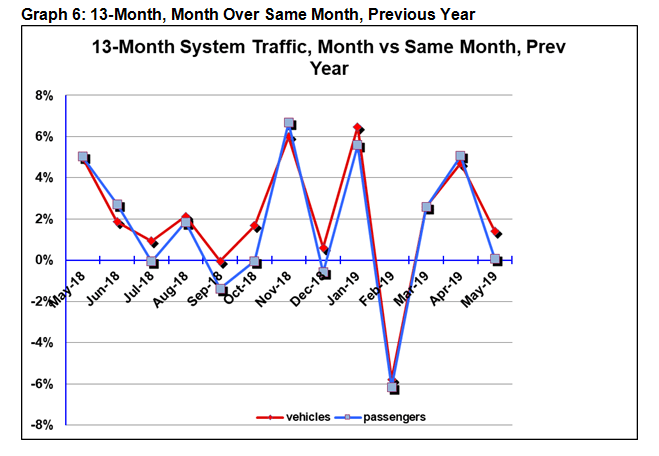

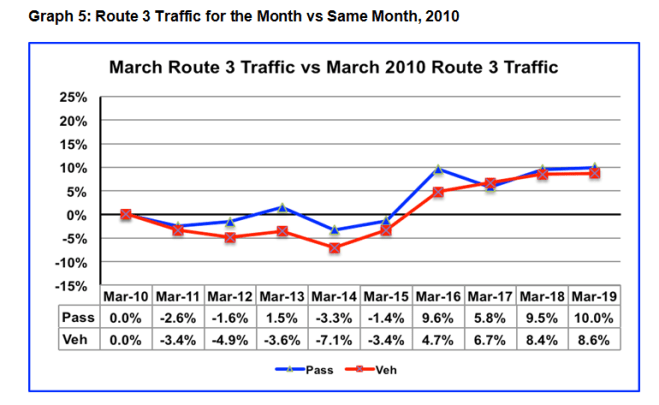

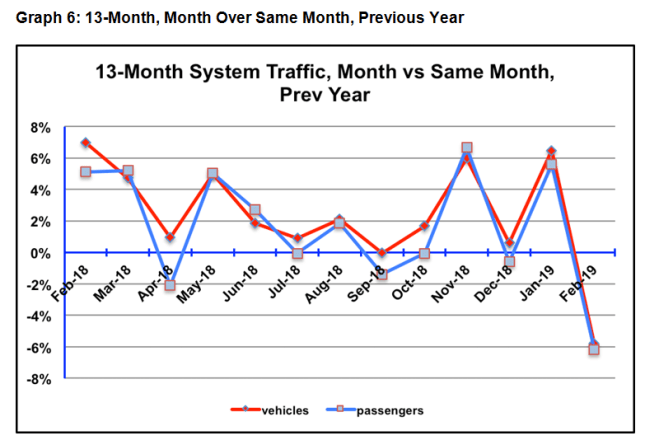

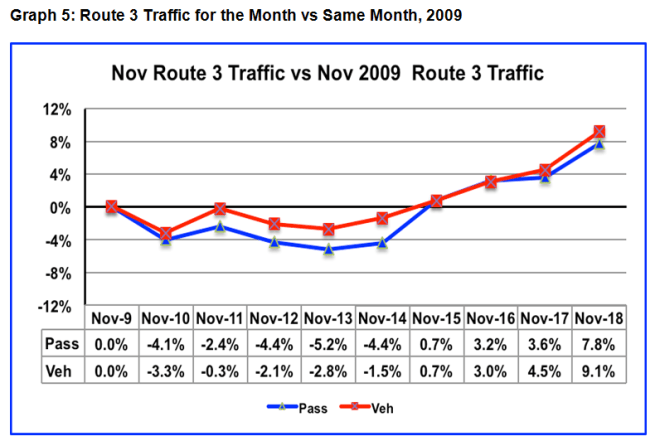

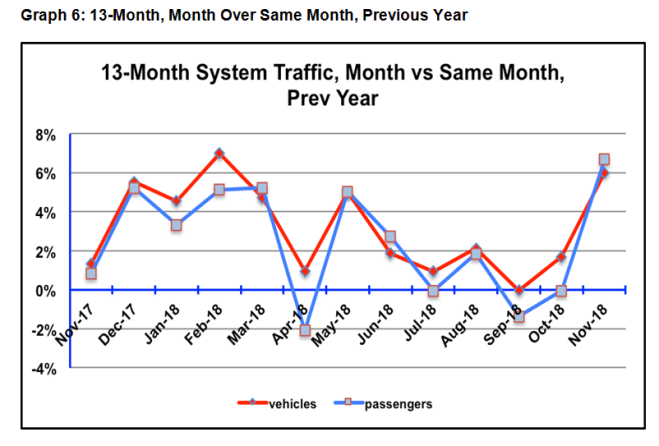

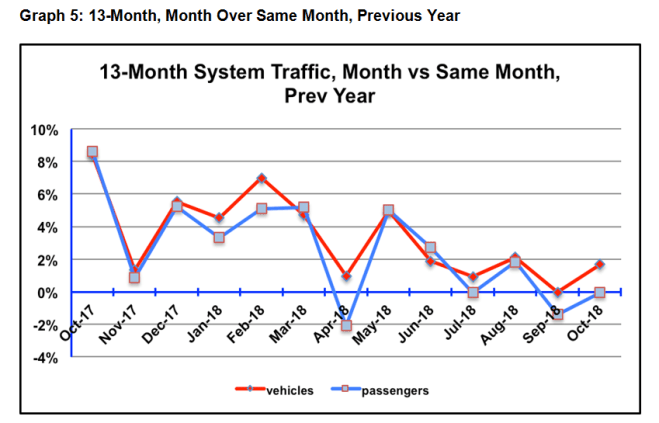

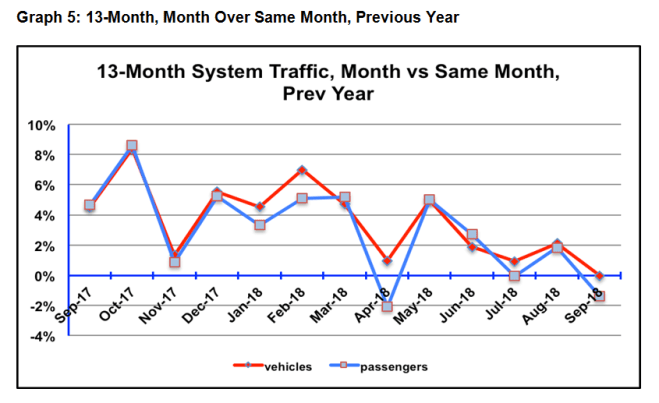

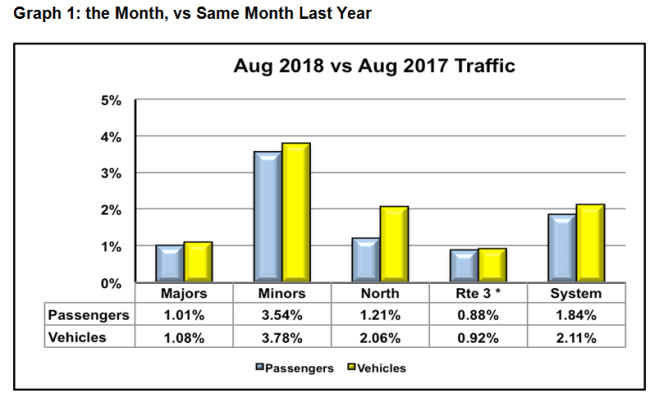

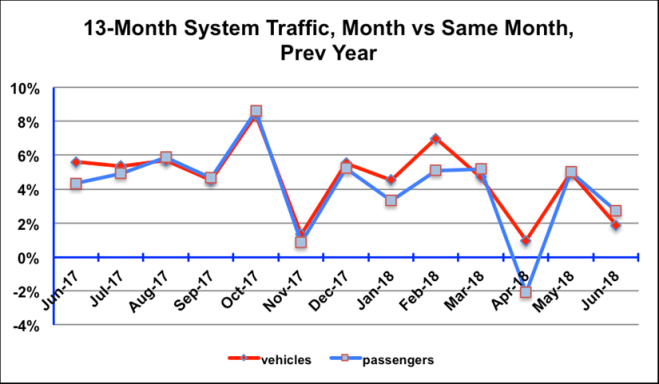

The 13-month System traffic look (Graph 5) pictures some excellent months, compared to previous year results, and some OK ones. This July was an OK one, but one has to bear in mind that last July, to which it’s compared, checked in with 5% traffic increases. Matching that traffic level, not too shabby.

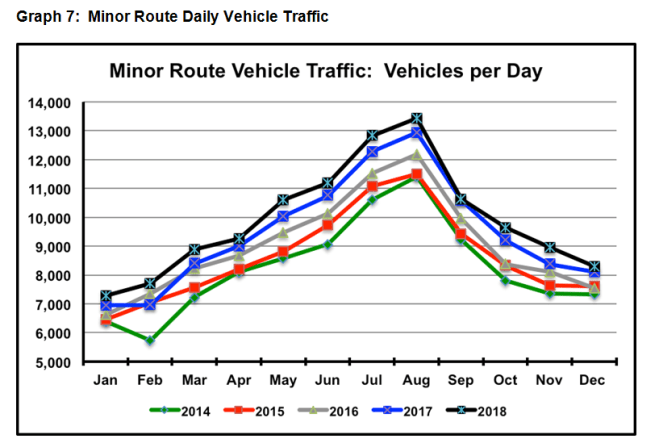

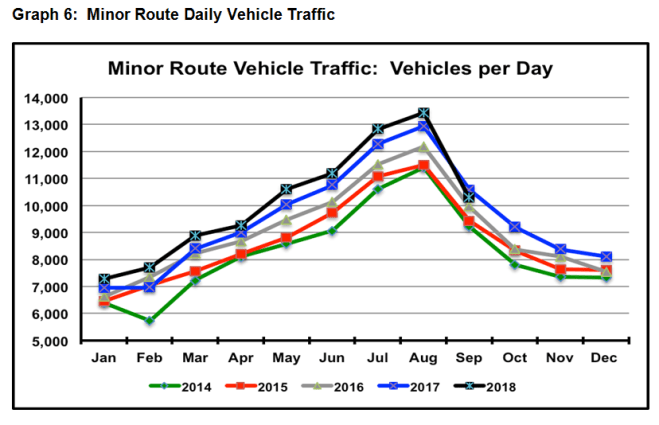

Graph 6, the Gabriola John Daily Traffic map shows the steady Minor route traffic growth for the past four years. Interesting that it’s consistent, year over year, and virtually every month. Not all routes present such a tidy picture, but in aggregate, it’s text book. Even now, this trend is being constrained by capacity shortfalls. As the newer, bigger ferries come into service, look for the growth rate to increase.

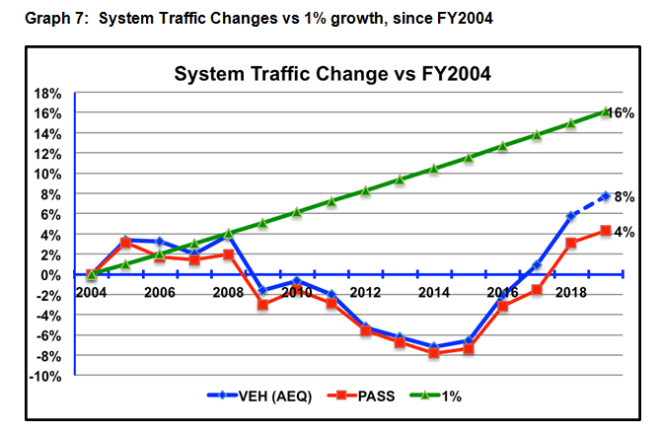

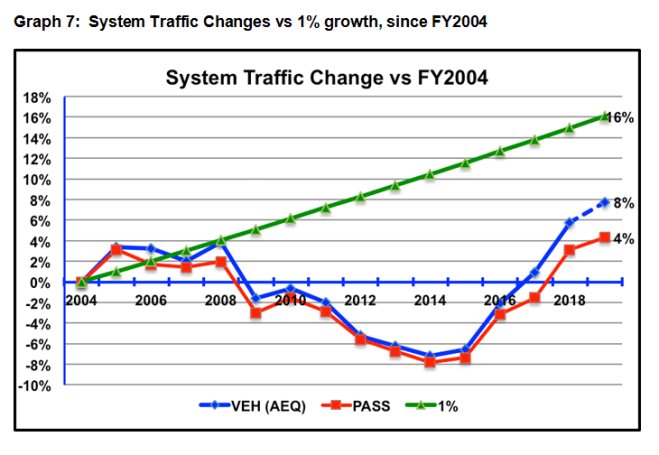

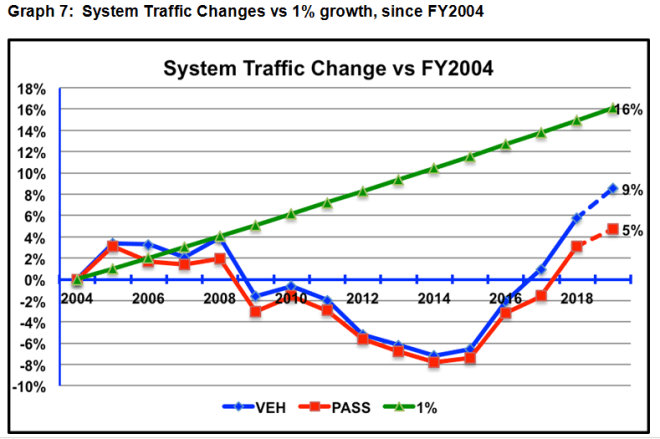

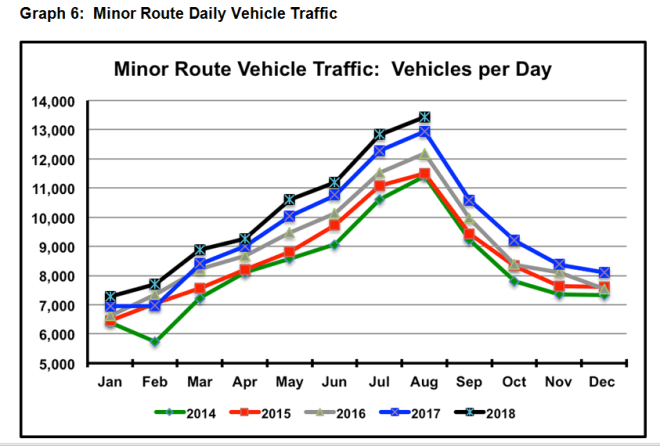

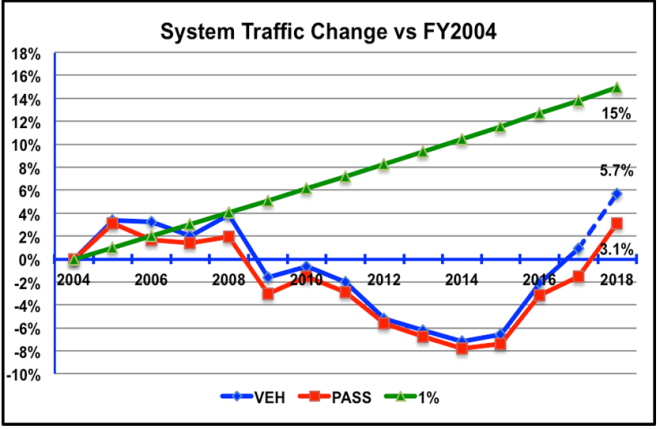

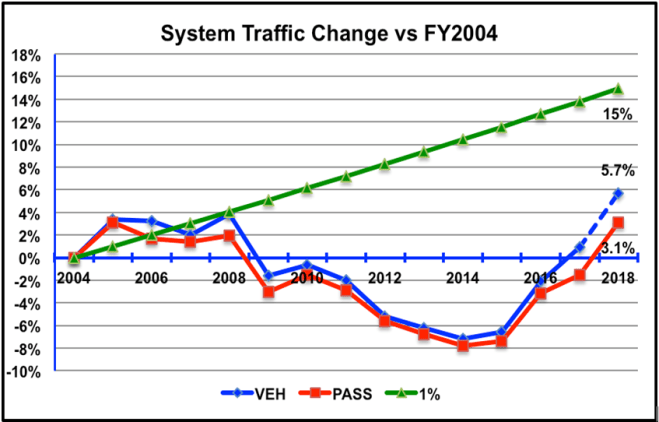

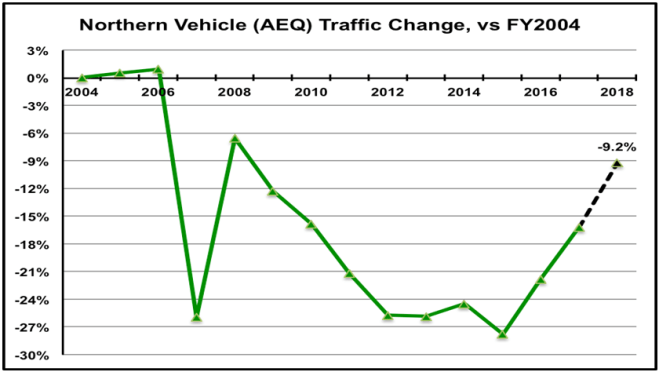

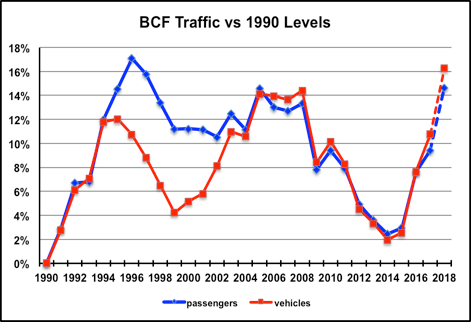

The Let Us Not Forget picture, Graph 7, illustrates the three year-traffic rebound after seven years in the ditch, and compares it to where it might reasonably have been in an earlier environment of modest fare increases. Increased tourism, population and provincial GDP, together with recent minimal to no fare increases have essentially made current fare levels more acceptable.

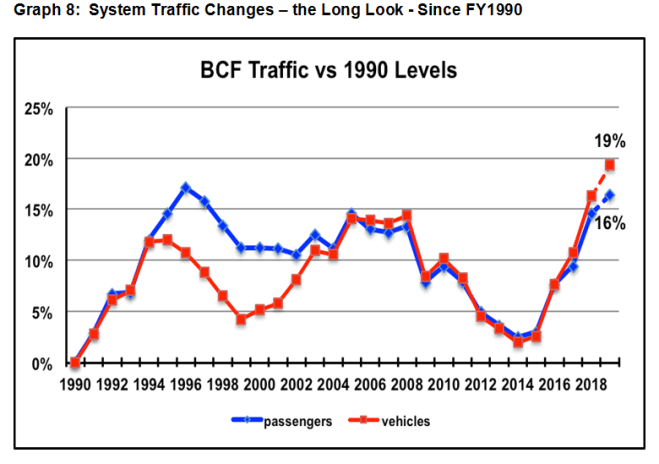

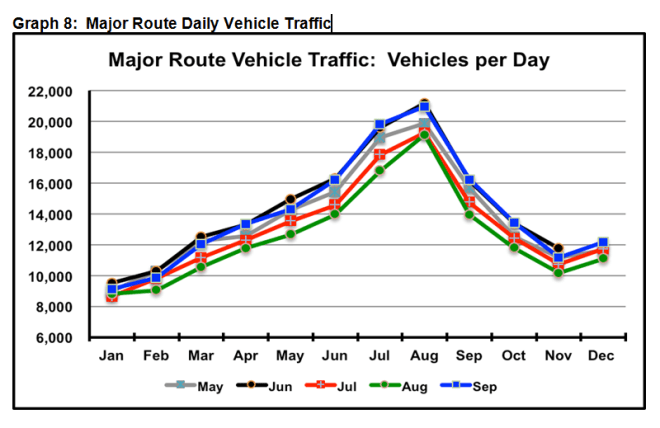

Graph 8, the Long Look, reminds us that indeed, BCF is now carrying more vehicles than ever. This appears to be more a recovery effort than a normal growth situation, traffic catching up to where it might have been in the absence of the ‘situation’ that collapsed traffic earlier.

So, what might we expect?

1. August results likely to be similar to those of July. Smoke, extreme fire hazard, drought. Not exactly inviting.

2. Year end results, positive due to 15% fare cut on all but the non-Big Three Majors and the seniors’ freebies, but dampened due to summer getting smoked out, and coming off bonus year last year.

3. Year to year expectations are based on no major changes. Possible major changes could include Climate Change (wildfires are real, not hoaxes) or substantial economic malaise arising from trade practices of our southern neighbour. As we’ve learned, there’s a lengthy dark menu of never-before-seen events that can dramatically alter our ferry world.

4. But for now, we have a magnificent coast, safe communities and a sound economy. Bodes well for the positive ferry service trends.

A new wrinkle . . . have a look at the CHEK attachment. CHEK 180827 long waits It appears BCF has dramatically increased the percentage of deck space they’re committing to reservations on rte 1, and possibly on rtes 2 and 30. That translates into more multi-sailing waits for the standby customers, competing for much less space on each sailing. Note Deborah Marshall’s reference to 45% to 75% of capacity being committed to reservations, if required. That’s the whole upper deck of a Spirit. And that, I believe, is new. At one time, getting to the terminal half an hour early for a mid-day sailing would get you on. People need to know that may well not work anymore. More likely to need a reservation. Noteworthy, that rte 1 traffic is down from July last year and August traffic likely will be down from last August. And yet, the multi-sailing waits. If nothing else, it will be good for revenue. I’ve asked what’s happening, and am awaiting a response.

Questions, comments, don’t be shy.

Brian Hollingshead Co-Chair FACC